What is auto enrolment?

Workplace pensions have changed and employers with at least one employee now need to be aware of their duties under Auto Enrolment.

Your staff will be automatically enrolled to a pension scheme in the majority of cases and will have to “opt out” if they do not wish to contribute.

Employers will need to pay a percentage of the pension contribution. We have put together some information on how much you will need to contribute and when you will need to start thinking about the scheme.

Staging Date

The staging date is the date automatic enrolment duties come into effect for the employer. They are likely to be sometime in 2016 or 2017. However you can find your start date online here:

http://www.thepensionsregulator.gov.uk/employers/staging-date.aspx

Point of contact

Each company must provide a point of contact.

Who needs to enrol?

1 Has a right to join a pension

scheme

If they ask you to, you must provide a pension

scheme for them, but you don’t have to pay

contributions.

2 Has a right to opt in

If they ask to be put into a pension scheme, you

must put them in your automatic enrolment pension

scheme and pay regular contributions.

3 Automatically enrol

You must put these members of staff in your

automatic enrolment pension scheme and pay regular

contributions. You don’t need to ask their

permission. If they give notice, or you give them

notice, to leave employment before you have

completed this process, you have a choice whether

to automatically enrol them or not.

Potential Opt out

Automatic enrolment duties don’t apply when a company or individual are not considered an employer. You won’t have any duties if you meet one of the following criteria:

- you’re a sole director company, with no other staff

- your company has a number of directors, none of whom has an employment contract

- your company has a number of directors, only one of whom has an employment contract

- your company has ceased trading

- your company has gone into liquidation

- your company has been dissolved

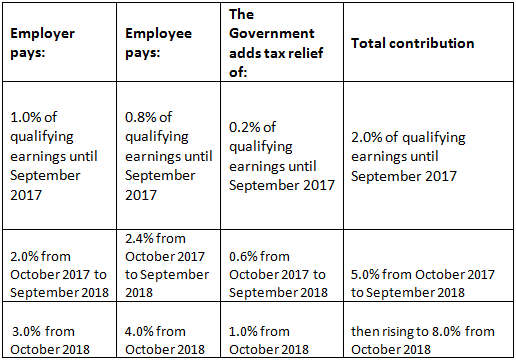

How much is paid?

The minimum total contribution to the scheme is usually based on ‘qualifying earnings’. These are gross earnings from employment that fall between the lower and upper earnings limit.

Please contact us if you would like more information on auto enrolment and how it impacts on your business.